Music. If you don't know me already, my name is Michael Burgess. I'm an attorney. The purpose of this video is to let you know what a deposition is and to go over some general rules for the deposition. Keep in mind, these are just general rules. Each rule would need to be more specifically geared towards the fact pattern, but these are general rules. Let me first tell you what a deposition is. A deposition is simply a question-and-answer session. That's all it is. When your deposition is being taken, the opposing counsel wants to know what's going on with your case. It is a question and answer session only, that's it. Let me tell you why your deposition is being taken. Generally, there are two reasons. The first reason is they're here to make an evaluation of you as a witness. Here's the theory: if you're a good witness and we have to take this case to trial, a judge is going to like you and likely rule in your favor. In which case, the defense attorney is going to be more likely to want to settle your case. Now, inversely, if you're a poor witness, the judge is going to dislike you, likely rule against you, and the defense attorney is not going to want to settle your case. The defense attorney is going to want to take you to trial because they think they will get a better outcome. It's very important to be a good witness, and being a good witness is very easy. You generally have to follow two things: one, be absolutely honest, and two, do your best to follow the rules I'm going over with you now. The other reason why your deposition is being taken is they're here to get information...

Award-winning PDF software

Florida Workers Comp Exemption renewal Form: What You Should Know

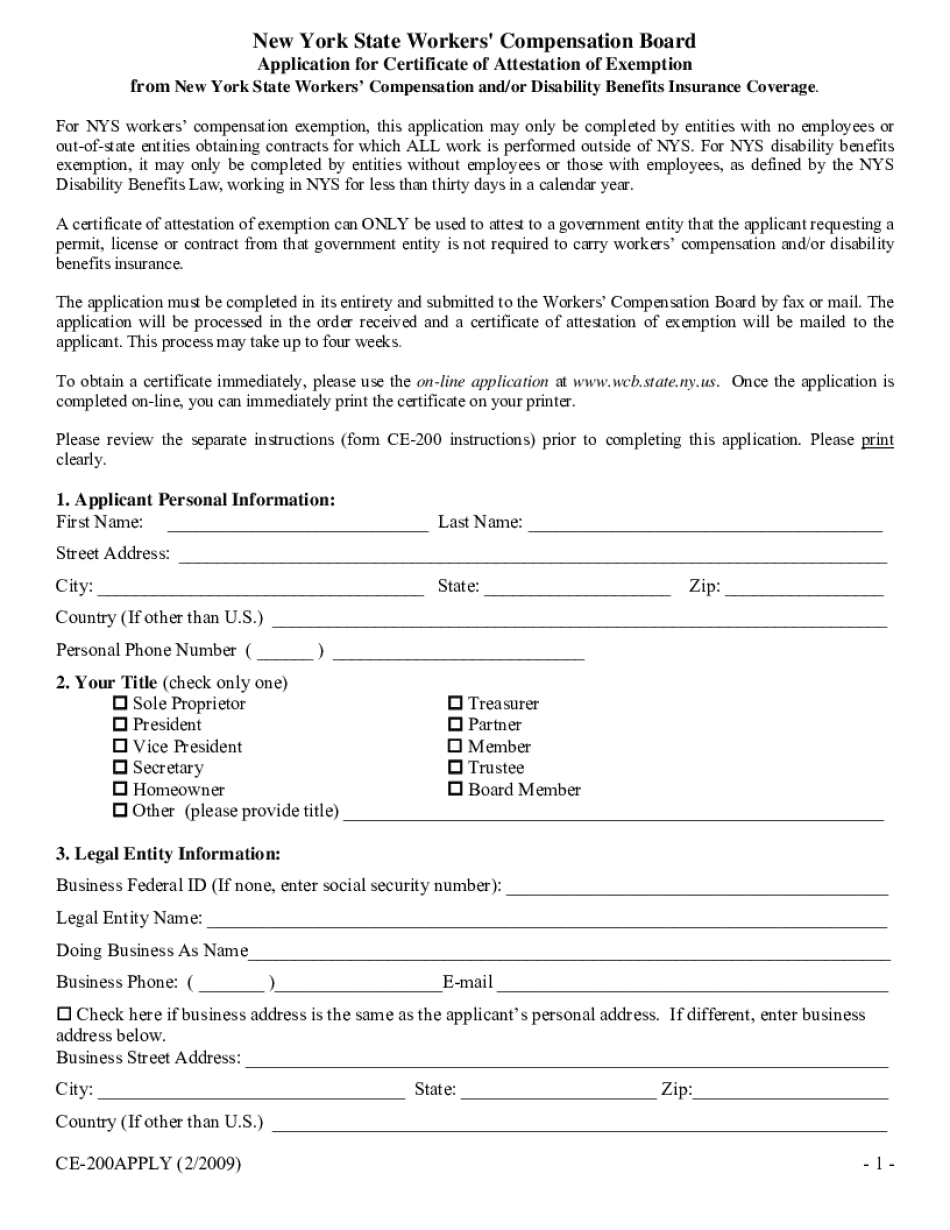

Exemption Notice Mar 1, 2025 — The final date to send a completed application for an exemption from workplace related injury/dismemberment insurance premiums. A copy will be sent via email. Workers' Compensation Exemption Notice.pdf. Form Number:.pdf Mar 10, 2023— Filing of an application for an exemption from workplace related injury/dismemberment insurance, along with the required fee. Workers' Compensation Exemptions Mar 17, 2022— Filing of an application for an exemption from Workers' Compensation coverage. Form Number :.pdf Filing of an Application for an Exemption from Workers' Compensation Insurance Form FPC 5101 (2x PDF).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida Workers Comp Exemption renewal