Good morning everybody. I'm Diana Wilson with Berkshire Hathaway Texas Realty and the Kent Read and team. Just like you, last year I bought my first home. So, it's January 2018 and it's time to get my homestead exemption going. So, I thought I'd walk you through the website and help you guys out with the form, in that way, you too can take advantage of your tax incentives. So, you do not need an extra service. You're gonna get a lot of mail that says, "Hey, for $89, we'll file this form for you." You don't need that. What you're gonna want to do is go to your County's appraisal district. So, if you're in Travis County, it's Travis CAD dot org. So, we're gonna go in pretty simple. Type it into your search engine. Within Travis County's appraisal district website, you're gonna see, in the very top center, forms. Click there and you'll go down to exemption forms. Then, in the middle of the screen, you will see homestead exemption forms. Simply click there and it defaults to an editable version in a PDF form, which is fantastic. So, you can go in and click any of the appropriate fields, edit, and once you're through, you can print it. Now, don't stress if you don't have a printer. You can print this off and hand fill it in. But, we're going to go ahead and utilize the PDF form. So, we're talking about 2018 because I owned my home on January 1st, 2018. I need to get it exempted for this year. But, I purchased in October. Did I own the property? Yes. I'm single, no judgments. If you're single, married, or other, or you own a property with other people, make sure that you check the appropriate...

Award-winning PDF software

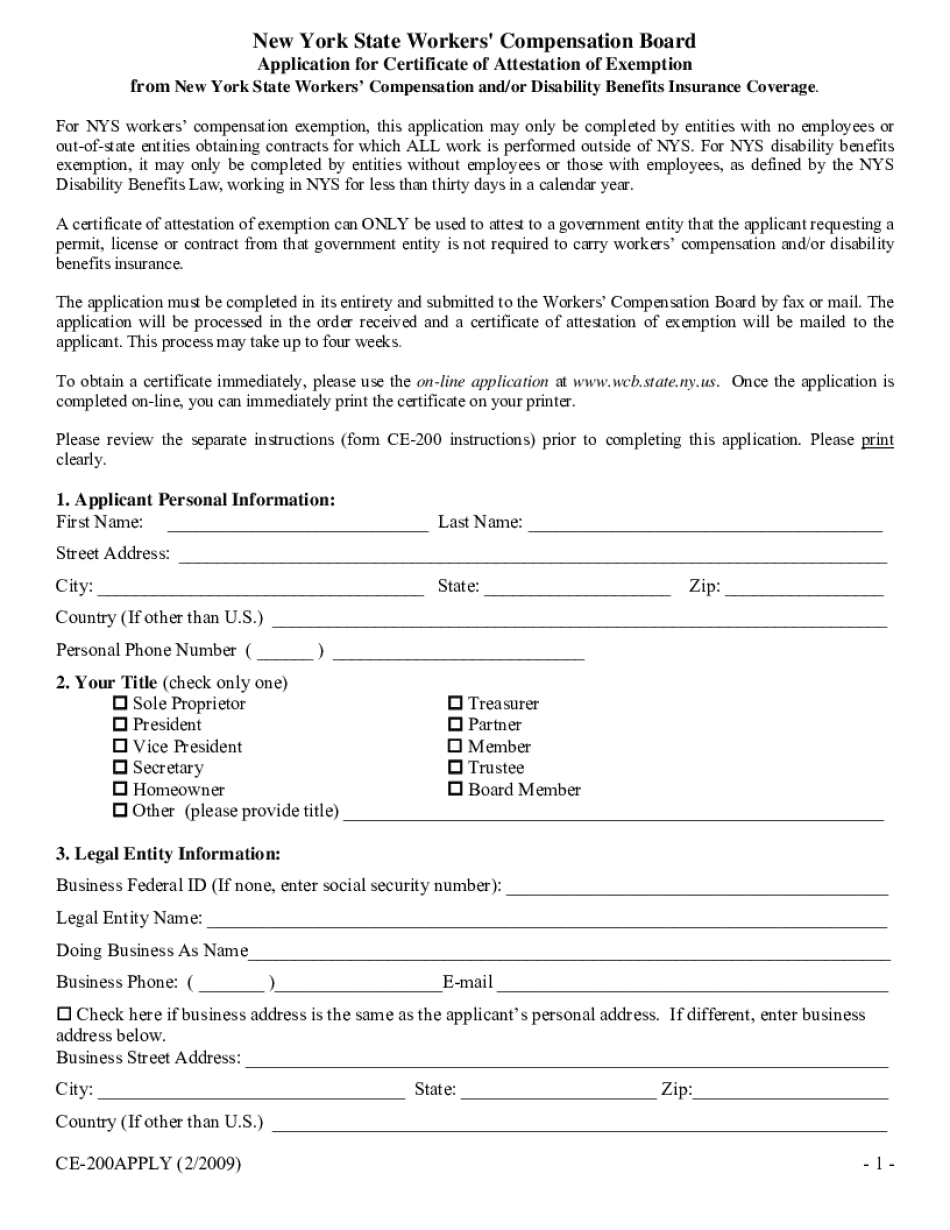

Workers Comp Exemption renewal Form: What You Should Know

Notice of Election to be Exempt in Florida Forms for Workers' Compensation Exemption Applications and Renewals Forms will be available on the Department of Financial Service website, and can be downloaded from the forms page Please note that the forms for exempting employers and certifying employees do not have the same format. The forms for exempting employers and the forms for certifying employees use the same template. Please Note that the Department of Financial Service's website is currently not currently accepting new forms for workers' compensation exemption applications and Renewals. Please visit this page of their website as an alternative way to submit the forms. The requirements for the notice of election to be exempt are listed below. However, the forms used to process these applications are very simple and will not require much information about your workplace. Click here for the Request Certificate of Attestation of Exemption (CE-200) The form for an exemption request is listed in its entirety below. Please do not provide any additional information that does not pertain to the application. (NOTE: the exemption request form may be completed in the Office of Labor Standards and Training website, and the online form is being available for anyone to submit.) Exemption Request to be Exempt Employer Certification Form The form for a certification of exemption issued from workers' compensation is listed below. Please do not provide any additional information that does not pertain to the business, as this will not affect this form. Please also note that the form is to be completed in a confidential manner. Exemption Certification Form Other Exemption Forms You may also review the list of other exemptions available for your business on the Workers' Compensation Exemptions — Florida Department of Financial Services, website. Employees' Certification Form If you are asking an employee to sign the Workers' Compensation insurance policy in compliance with your state regulations, you must give him or her a Workers' Compensation medical certificate to sign. The form for an exemption to give to an employee's doctor is listed below: Exemption Notice for Worker Sign a Medical Certificate Form for Employer to Give Medical Certificate to Worker's Compensation Doctor If you do not have insurance, but your employees do, you may need to submit the exemption form to the workers' compensation commissioner.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Workers Comp Exemption renewal