Welcome to the legal view with Ferrand Farah. I'm Eddie Farah, and with me today is Mr. Bruce Pfeifer, who supervises our workers' compensation department. Bruce, I have a question for you today. Can you tell us about what's entailed in settling a worker's comp claim? Well, once you settle your workers' compensation case, you are trying to resolve the case to gain more freedom from the stringent workers' compensation system. Under the system, you have to see the employer's carriers' doctors. By settling your claim for a lump sum, you're gaining more freedom to choose your own doctors and take control of your case and your life. That's one of the most positive things about settling your workers' comp case. The value of your case is based upon future exposures. So, when settling the case, you need to consider what's expected in the future. You should interview your doctors and gather information about potential future surgeries, injections for pain management, prescriptions, and their costs. This information will help determine the value of your claim. Additionally, if you're unable to return to your past work, the cost of vocational rehabilitation can be factored into the settlement. The insurance company is responsible for paying your lost wages for up to 52 weeks if you attend a program approved by the state of Florida for vocational rehabilitation. So, Bruce, the more future medical expenses and lost wages you anticipate, the higher the settlement with the workers' comp claims. Is that correct? Yes, that's great. Absolutely. I am involved in trying to determine those amounts. We write to the doctors to gather information about the future medical care that will be involved. Moreover, if someone is receiving Social Security Disability, we need to gather even more thorough information because a Medicare set-aside (MSA) will need to...

Award-winning PDF software

Florida Workers Comp Exemption database Form: What You Should Know

Click HERE for a printable version. For more information, please contact Divisions of Workers' Compensation by calling toll-free at or email: infodeptof.FDB.state.fl.us. The Division of Workers' Compensation also offers the following forms/documentations: Workers' Compensation Insurance Certificate of Exemption Notice of Election to be Exempt Worker(Period of Exemption).pdf Notice of Election to be Exempt .doc. F.D.W.C, Vol. 58, No. 4 CERTIFICATES AND ADMINISTRATIVE RECORDS. If you have not received a certificate, please contact Workers' Compensation Division at.

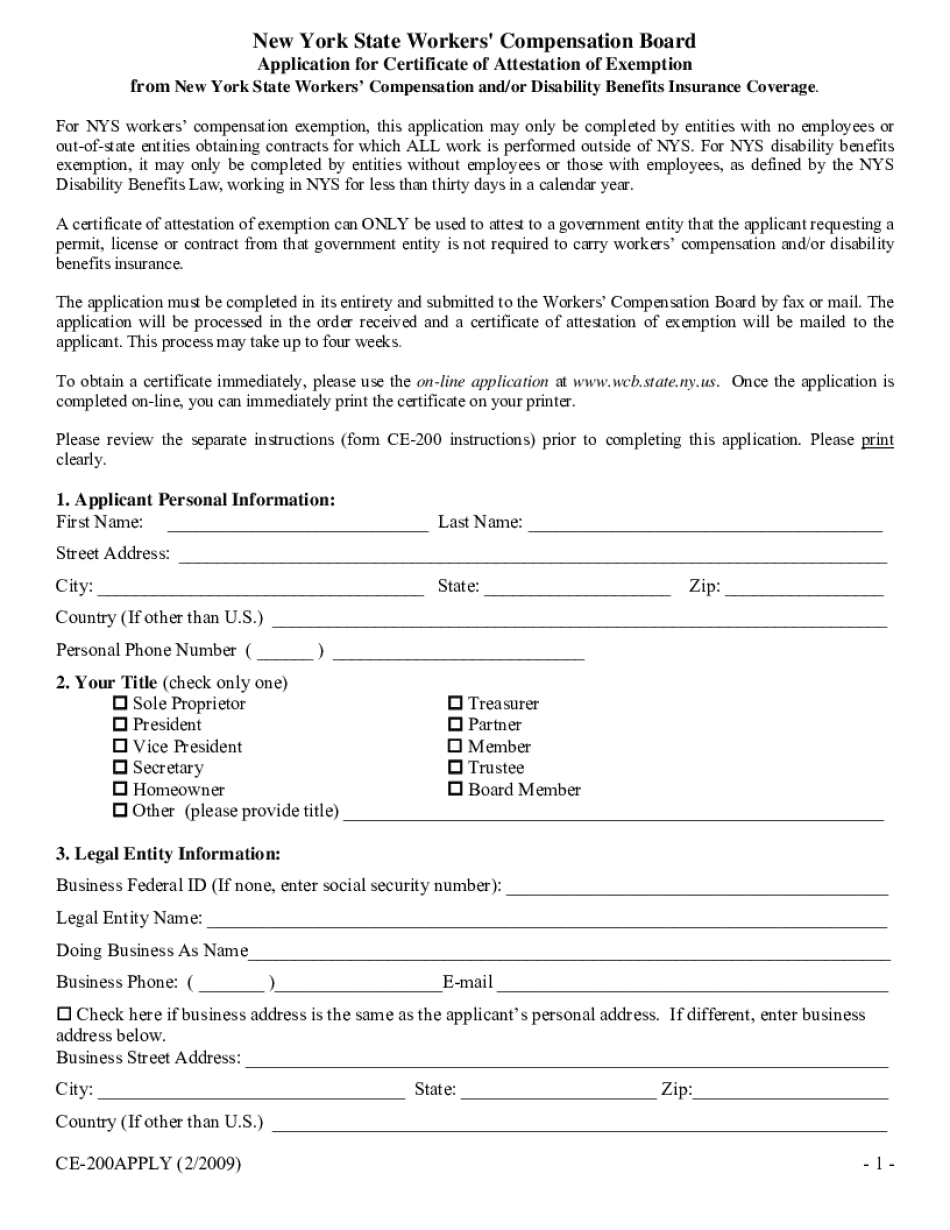

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida Workers Comp Exemption database