One thing we hear consistently from business owners is that they think they are too small to have to worry about carrying workers comp insurance. But we ask, what happens if you don't have workers comp coverage and an employee gets hurt? Well, the answer is you end up paying out of your pocket what could be a large amount of dollars, versus pennies on the dollar for the coverage you could have had but you chose not to. Because you think you're saving money by not covering your employees and yourself. Let me share a quick true story with you. I walked into a prospect's business one day, and I had set an appointment with him to go and talk to him about workers comp coverage for his fairly new two years old and growing business. It's basically a smoothie shop. And he launched into a story about how last year, his wife was in the back washing dishes while his two part-time high school employees on a Saturday were working the counter serving the smoothies and attending to the customers. His wife accidentally sloshed some water onto the floor, and not realizing it, she turned to go back out into the shop and help with the customers. She slid across the tile floor and hurt her back badly. Her medical bills set them back to the tune of $75,000 out of their pocket. He told me this incident had almost bankrupted them. I explained to him that if he had been someone other than his wife who was injured, it could have cost him much, much more. Legal fees, lost wages, rehab services could have stacked up on top of all the other medical expenses with the back injury, and the business would have been liable. After sharing...

Award-winning PDF software

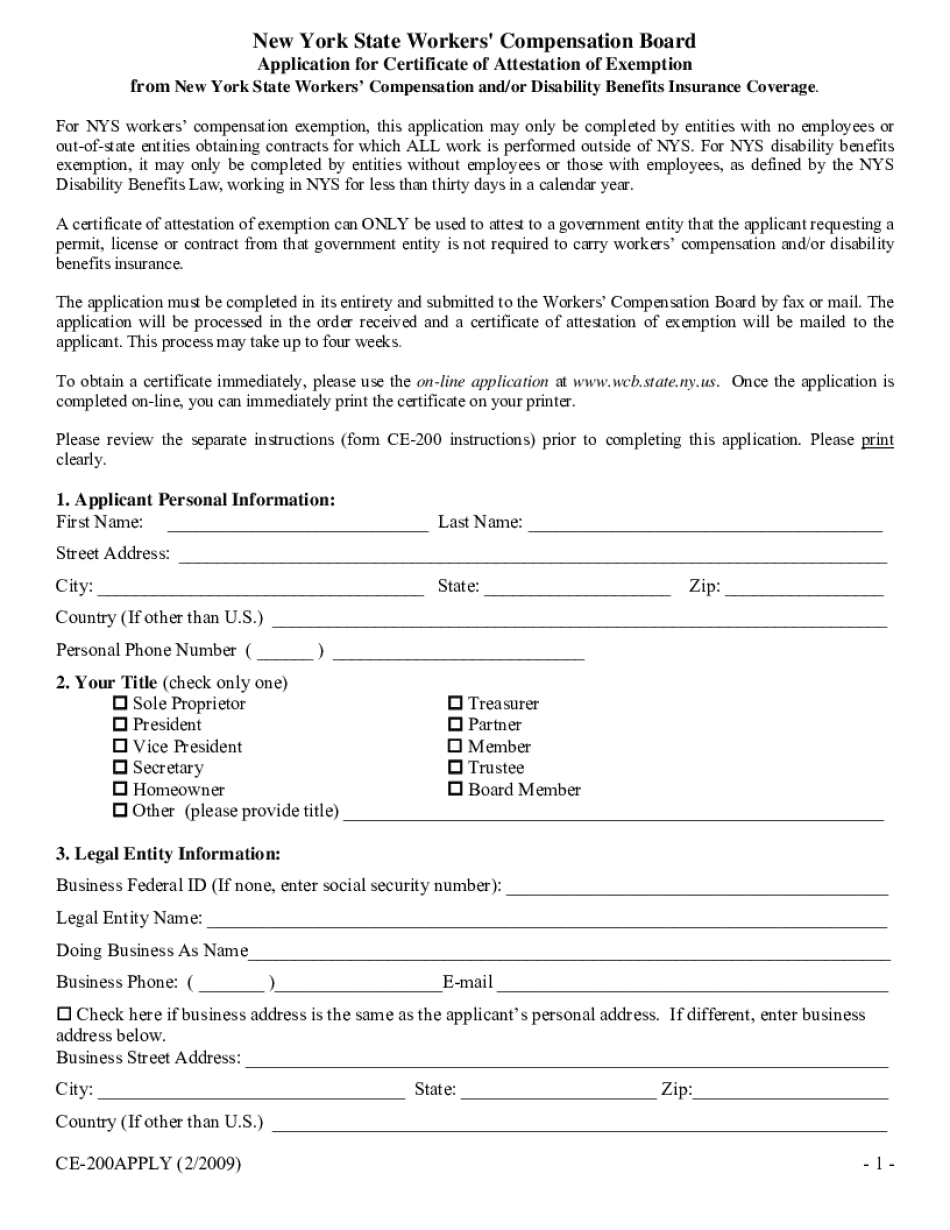

Workers Comp Exemption sole proprietorship Form: What You Should Know

Form 945 — Florida Department of Economic Opportunity You may file this form if you have not filed for workers' compensation coverage since the day before the effective date of the legislation. Form 946 — Worker's Compensation Board If you are an employee and are filing for coverage, this form is also available for you to provide the information needed for your exemption.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Workers Comp Exemption sole proprietorship