Award-winning PDF software

Workers Compensation Exemption renewal Form: What You Should Know

If you would like to add to your existing exemption notice you must download or upload a new exemption notice here. Click on your name and date of birth to proceed to the exemption application In order to receive payment for your exemption notice your tax identification number (TIN) must be on file with your county. If you do not have a TIN, you simply need to check the box for the county you are submitting exemptions to. You must upload your application through our exemption submission online system to complete the exemption process. In order to be valid, all information submitted through this website will be verified. There are a few steps required to take on our exemption notice submission website. You will need a valid driver's license and your county will need to see the TIN provided you on your exempting notice You'll need to complete an exemption application and pay the fee associated to your exemption Our Online TIN System You will need your TIN to verify your exemption notification. Please select the county in which you would like to receive exemptions. Please confirm your answer by checking the option for “yes”- “no.” Your exemption notification is not ready. This page will open in 15 seconds. If your exemption notification is not yet done, please wait for a few minutes as we are waiting for your TIN. Please complete the following check box(BS): YES- NO. If you check no, you will not be able to submit your exemption notice. Please click on the correct box, and then click submit. Please note, you will be redirected to the online exemption website to complete the required process, but we will not be receiving your exempted status until your payment has been processed. We will then send you a confirmation email to our email address listed in your county to enable you to proceed with processing. If you want to download the application for your exemption click here If you want to print out the exemption application for your specific county click on the link below. If you have any questions or would like assistance with our exemption services, please contact them at. You are also welcome to contact the county worker's compensation commissioner's Office at as well as a CSL representative at.

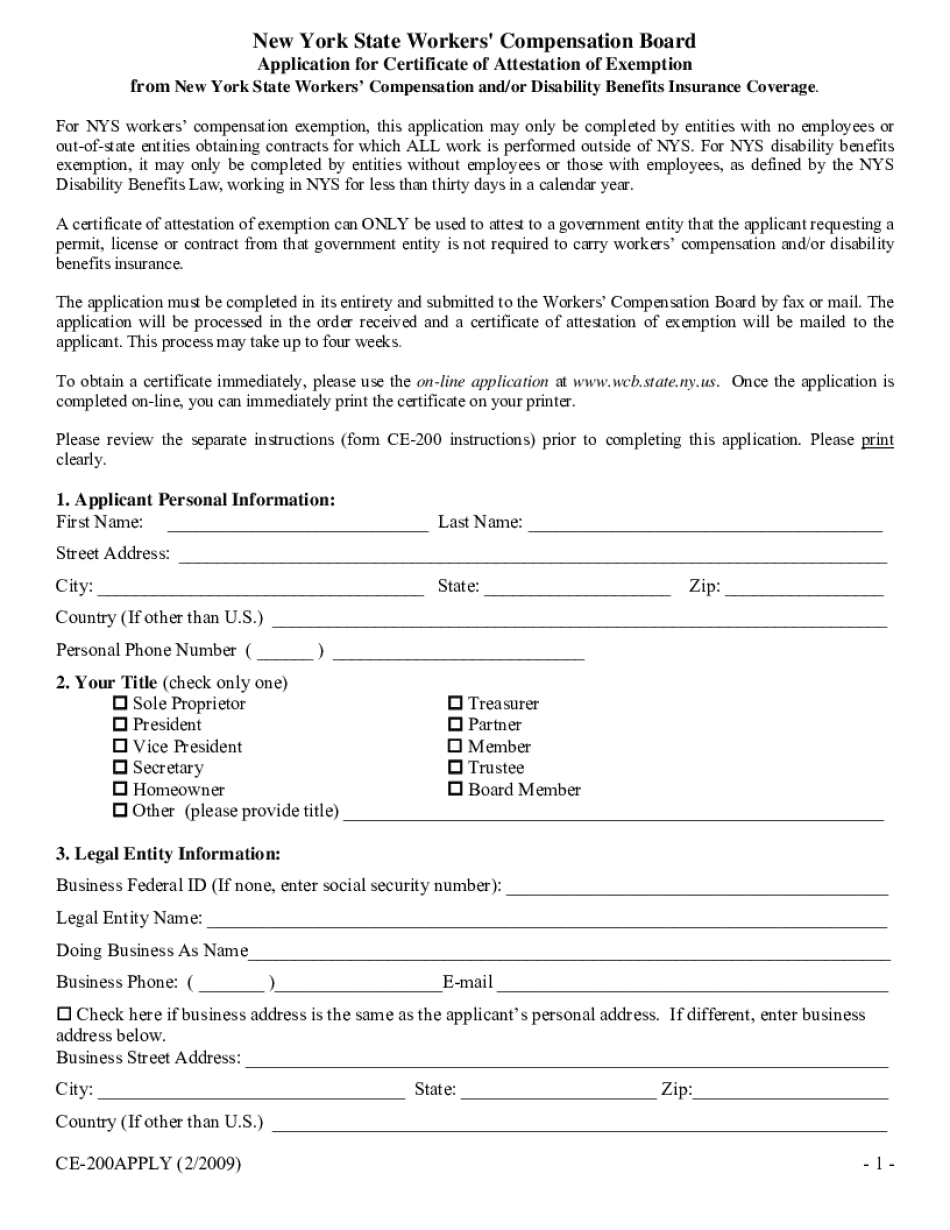

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.