How to obtain a reseller permit sales tax ID. - Sales tax is a tax on the end purchase of a product or a service, and is imposed on all retail sales, leases, and rentals of most goods, and on some services that are considered taxable. - Sales tax normally does not apply to the purchase of a product intended for resale or for subsequent processing. - Sales tax is usually represented by a certain percentage added onto the price of a good or service being purchased. - Your sales tax responsibilities as a new business owner will vary depending on the type of organization or entity you operate. - Estimation of sales tax is also done on municipal or county levels, in addition to the state level. - Payment of state sales tax depends on your sales and your state's regulations. - Sales tax is intended to be applied to the end user, so normally it is the consumers who are burdened with it. - Resellers, on the other hand, are exempted from sales tax if they do not use the goods on which sales tax is levied. - Some states do not have sales tax, including Alaska, Delaware, Montana, New Hampshire, and Oregon. - A sales tax ID number or sales tax exemption certificate is a legal document issued by the state that gives your business the authority to collect the required sales and use taxes. - It also allows you to obtain appropriate sales tax exemption documents, including resale certificates used for purchasing inventory. - The sales tax ID number comes in different forms and is also known by other names such as reseller permit, sales tax vendor ID number, sales tax registration, reseller tax ID, sales tax permit, bill's tax exemption certificate, certificate of authority, state tax ID number, and reseller certificate. - If your business is required to...

Award-winning PDF software

Ny Certificate of authority Form: What You Should Know

Also make sure you save your Certificate of Authority with your other forms. Please do not send your application to the DT without submitting your Certificate of Authority first. You can do this by logging into your account on the NYS tax site by registering under the Sales Tax tab on the left and clicking New Sales Tax Payment Information. In this page, select “Request NYS Certificate of Authority” to submit your Certificate of Authority. These forms are available on your sales tax registration certificate: Required Taxpayer Identification Number (ID Number): Taxpayer's Identification Number (PIN) is a seven-digit number assigned by the New York State Department of Taxation and Finance to every individual who is an eligible taxpayer when the Tax Law takes effect in January 2019. The Taxpayers Identification Number (PIN) is the first two digits of the taxpayer's New York State residential address. New sales tax registration certificate (NYS Certificate of Authority) You should send this application to: Sales Tax, New York State Department of Taxation and Finance Attn: Sales Tax Vendor Registration 33 Liberty St., Ste. 100 Bronx, New York 1 Tax ID #: 11011117-5S8 The NYS certificate of authority is an ID which must be kept on file with your sales tax vendor registration application. You must keep the NYS ID number on your sales tax registration information for 2 years after you make all sales tax sales. You must keep the NYS ID number on your sales tax certificate for 5 years upon termination of your sales tax vendor registration. In order for you to register the sales tax on taxable sales, you must have the NYS ID number provided in the Certificate of Authority. For registration, you must also provide the business identification number and the customer's identification number. This form is used for New Sales Tax vendor registration: Business Identification Number: This is a ten-digit number assigned by your State Department of Taxation and Finance (DT) to business selling taxable tangible personal property or taxable services and is an identification number used to establish the business tax exemption under the Tax Policy Framework (TPP) as explained here. Please note, that any non-taxable commercial motor vehicles purchased by a single purchaser at the same time must be registered with DOT. The dealer registration must be the last digit followed by the word “1.

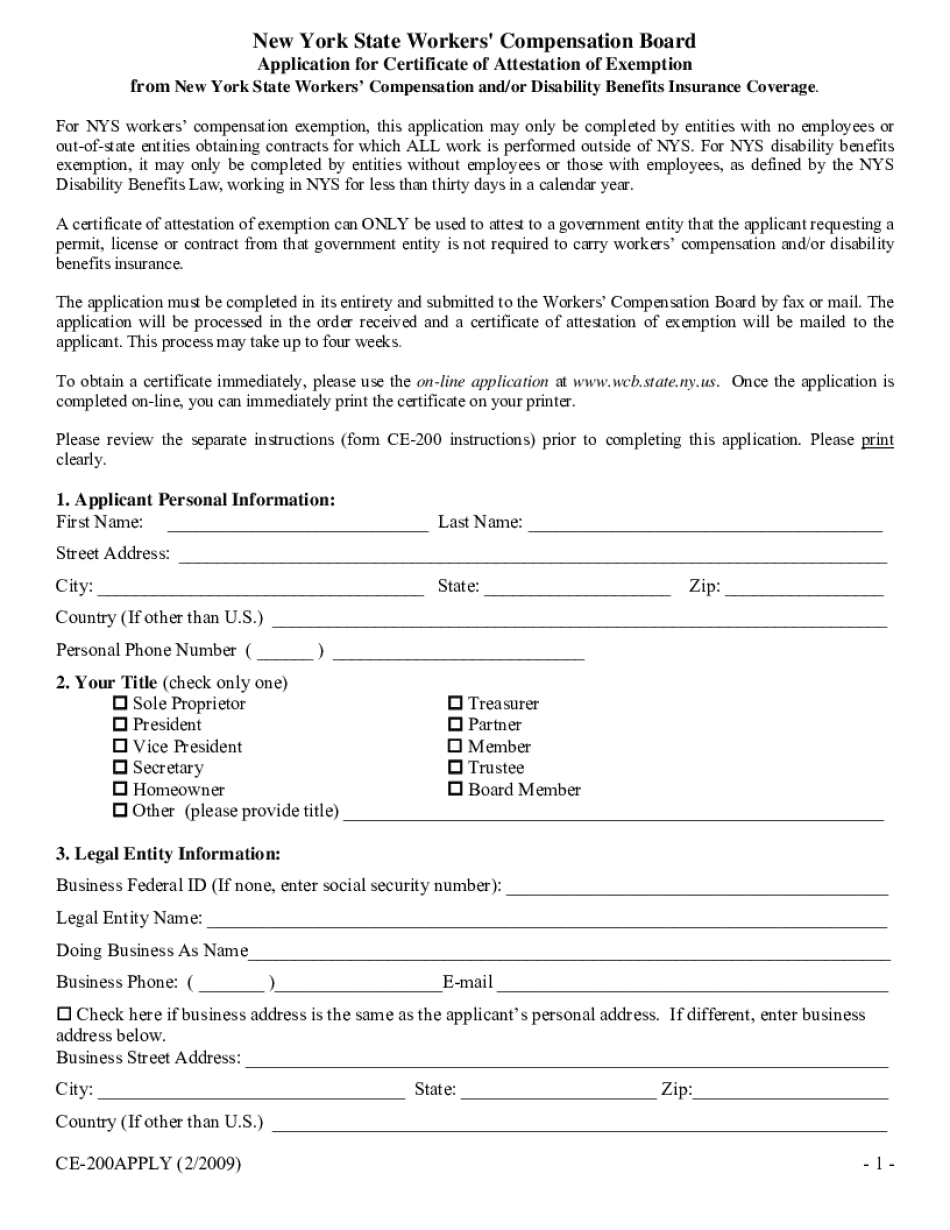

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ny Certificate of authority