All right, people! What's up? This is Kevin from Dropshipping: The Way of Life, back at you with another new video. It's been a while, I've only had two videos. Yeah, it's been a while, but I've been alone enough. Alright, so what I want to talk to you today about is becoming tax-exempt. I'm by far not a tax professional, but I am tax-exempt in quite a few states. I only have about maybe seven more to get tax-exempt and to get my resale certificate in. And it's really easy to do it. You can lower your price by seven and ten percent. You have to admit that sales tax, but you can charge less upfront so you get more sales. Even though they're gonna pay sales tax after they buy it, they're still gonna choose the lower price the day that's in front of their face to start with. The price could be the exact same as what somebody else is charging that doesn't include it already has tax included after they buy it from you, and then you charge them tax. It could be the same exact price, but they're gonna buy it from the person as the cheaper or like the price they see this cheaper whether they pay tax on it or not. So, overall, it just gets you more sales and you make more money. Sorry, it's really easy to do. The first thing you want to do is you want to register a business. Alright, so in the state that you're in, you want to register your business. You want to become an actual business owner, registered business owner. So, whatever state you live in, this is what I did. I live in North Carolina. So, I just went to I typed in how to...

Award-winning PDF software

Nys tax exempt st-119 Form: What You Should Know

Use tax on all the products and services the organization purchases and/or uses in the State of New York. Feb 14, 2025 – We'll issue a tax exemption for you. It will contain your six-digit New York State sales tax exemption number. ST-119.2 Sales Tax.NY.gov Please read this important information before you submit your application. It will help you prepare and complete the application correctly. If you have any problem using this application, please contact us. For help with sales and use tax, call our toll-free Sales and Use Tax Help Line at anytime, Monday through Friday, between 8 a.m. and 6 p.m., Eastern Time, or write us a letter. Please understand that you are using our website for tax advice.

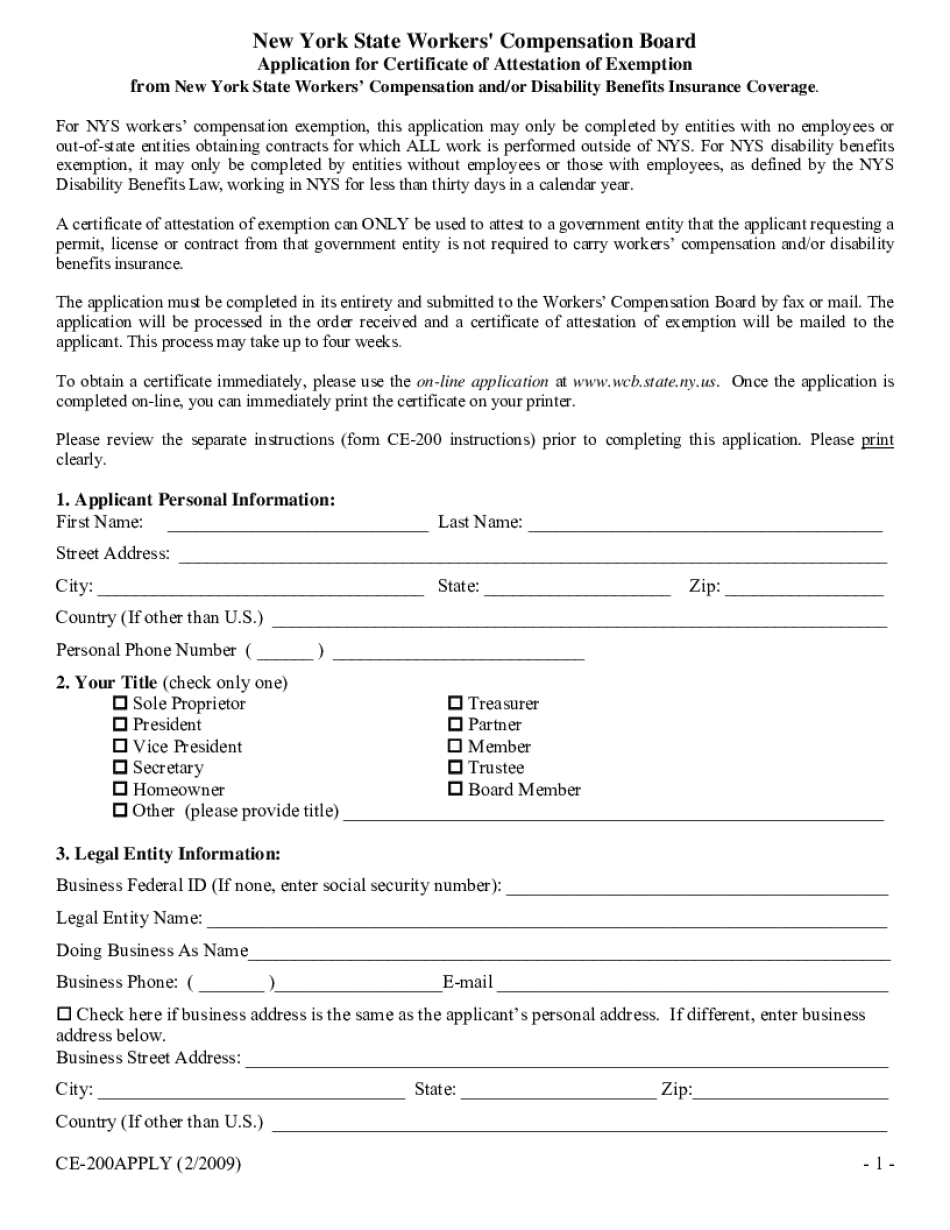

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nys tax exempt form st-119