Good morning, everyone. This is Christine Serafini Miranda from the real estate group. I just wanted to give a quick reminder that the enhanced senior star exemption application or renewal is due on March 1st, 2018. This is a great tax benefit for senior citizens as it offers a discount on your school taxes. So, don't forget to renew your application before the deadline on March 1st. To do so, you have two options. First, you can visit City Hall. Alternatively, you can do it online by visiting tax New York gov. The online process is very convenient, and you will need your 2016 income information to complete it. Please note that if you are 65 years or older as of December 31st, 2018, you are eligible to receive the enhanced senior star program benefits on your school taxes. I encourage everyone to take advantage of this opportunity for free savings. If you have any questions, feel free to give me a call at 518-514-8830. I am here to help. Remember, Serafini sells homes. Thank you and goodbye.

Award-winning PDF software

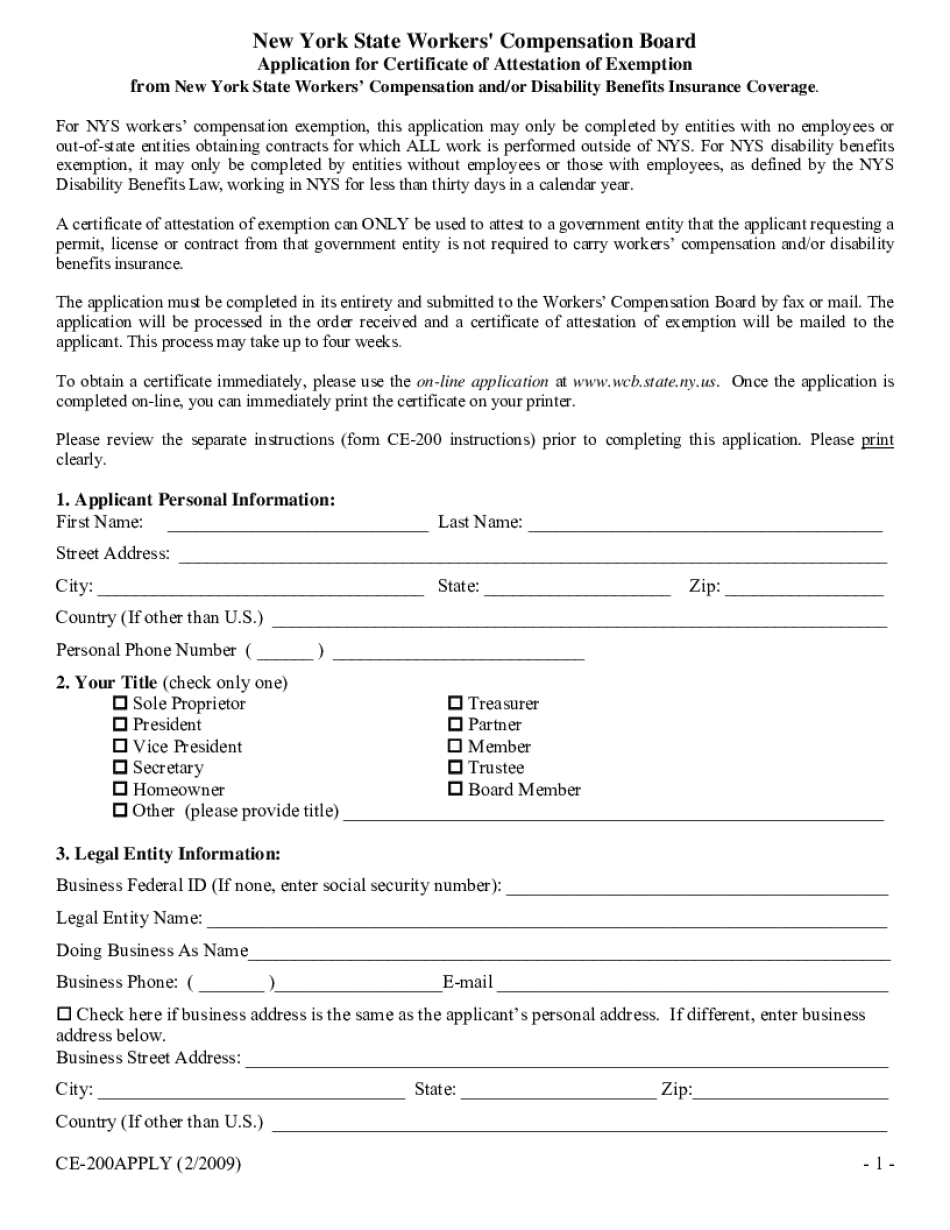

New york exemption Certificate verification Form: What You Should Know

Premises a permanent and fixed place of business; as a primary address, that my principal place of business is located in New York State, and that my principal place of dwelling is located in New York State and is used for my primary and secondary residences; and that a substantial quantity of my goods or services, including inpatient and outpatient services, that are furnished or sold or used for the purpose described above, are sold only in a state of the United States or the District of Columbia. A copy of the certificate must be provided with any registration or request of certification, but no certification of exemption is valid from this point of view if a nonresident or an employee of another state applies. A certificate does not create an authority to do business in the state in which the person is employed or where the certificate is issued unless such authority has been obtained before registration or application; if such authority is claimed in the state where such person is currently employed; or if the certificate can be shown to have been issued in such person's place of birth, residence, or place of business. If you need to update your address, visit the New York State Department of Taxes website for contact information. Alternatively, you can print this certificate or the information below and submit it to your local office for updating. Please note that you may not need the state's certificate for each location that would qualify for the exemption, but you may need a copy of the certificate for each location because in some states the business need only provide the address where the customer would be making their purchase. For more information about the Workers' Compensation Exemption, please visit our New York State Workers' Compensation Board link here.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ce 200, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ce 200 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistanCe team.

- PlaCe an electronic digital unique in your Ce 200 by using Sign DeviCe.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduCe the gadget.

PDF editor permits you to help make changes to your Ce 200 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing New york exemption Certificate verification